The remarkable 7.7% month-over-month increase in home sales activity is a notable development, especially compared to the more modest gains of 1.9% and 1.3% in September and August, respectively.

This surge in activity presents a complex landscape with both opportunities and challenges for buyers, sellers, and real estate professionals. While demand (measured by sales) is on the rise, there has been a corresponding increase in supply (measured by new listings).

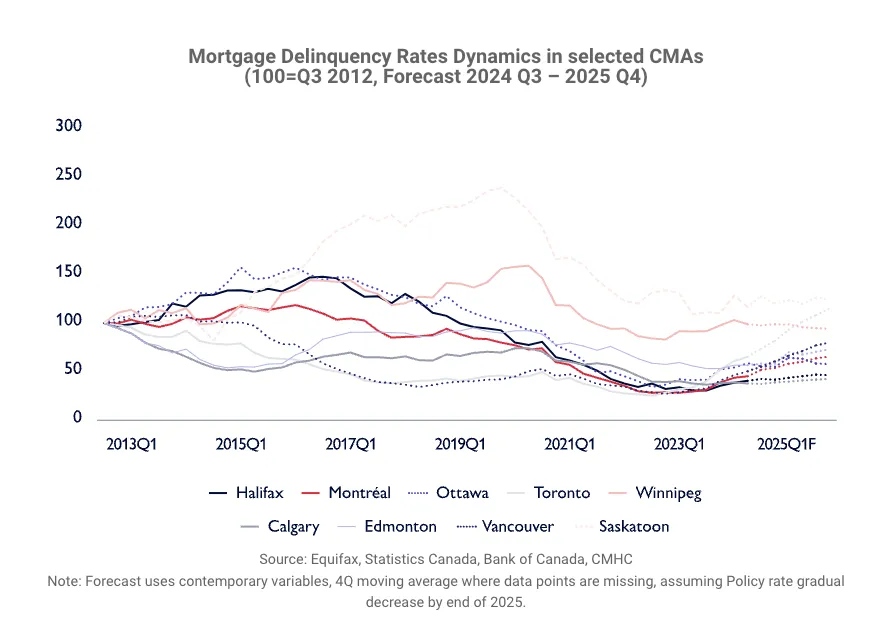

For sellers, this surge in activity brings positive news. The increased demand could result in faster sales and price appreciation in the absence of sufficient supply. However, there is a potential for a “pent-up supply” situation as indicated by CMHC’s reports on rising mortgage delinquencies in various Canadian cities.

Real estate professionals are also poised to benefit from this upswing, with more transactions likely leading to increased commissions and business opportunities.

However, buyers may face a more challenging market. While lower interest rates have improved affordability, the sudden increase in market activity could result in heightened competition and reduced affordability.

Given the backdrop of rising unemployment, the market may quickly absorb any potential benefits from lower interest rates, extended amortization periods, and upcoming $1.5-million insured mortgages in December, emphasizing the need for preparedness and decisive action in an active market.

Supply and Demand Balance

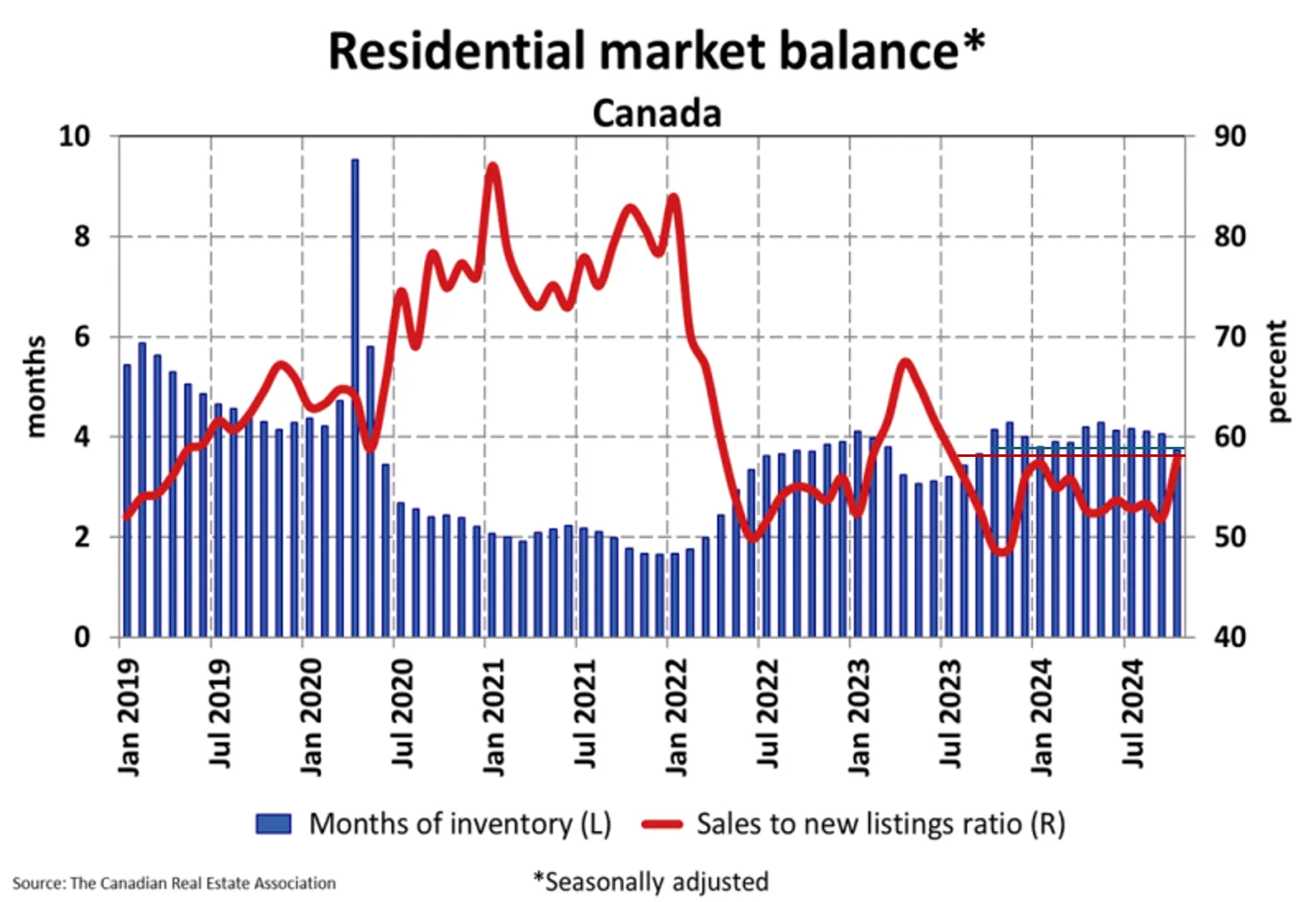

The balanced growth in both supply and demand has brought about a somewhat unpredictable market scenario. The sales-to-new-listings ratio is rapidly increasing, while months of inventory are dropping to levels not seen since the summer of 2023.

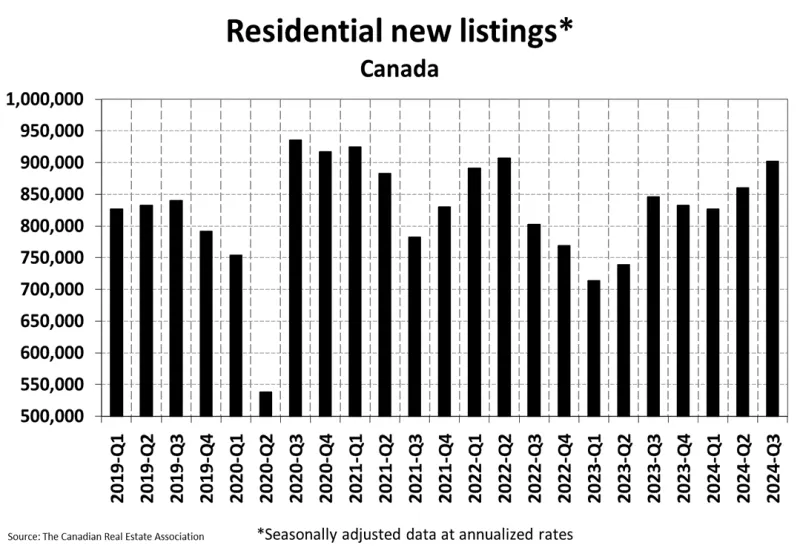

The interaction between supply and demand is pivotal in understanding the market’s direction. Despite a 3.5% month-over-month decrease in new listings in October, the quarterly trend is on the rise, and the number of active listings is 11.4% higher than the previous year. This increase in supply is advantageous for buyers, offering more options and potentially moderating price increases.

The tightening sales-to-new listings ratio at 58% signals a shift towards a more balanced market. This equilibrium could benefit both buyers and sellers, creating a more stable environment for transactions. However, with inventory levels at 3.7 months—the lowest in over a year and nearing seller’s market territory—prices may face upward pressure if this trend continues into the spring market.

Price Trends and Regional Variations

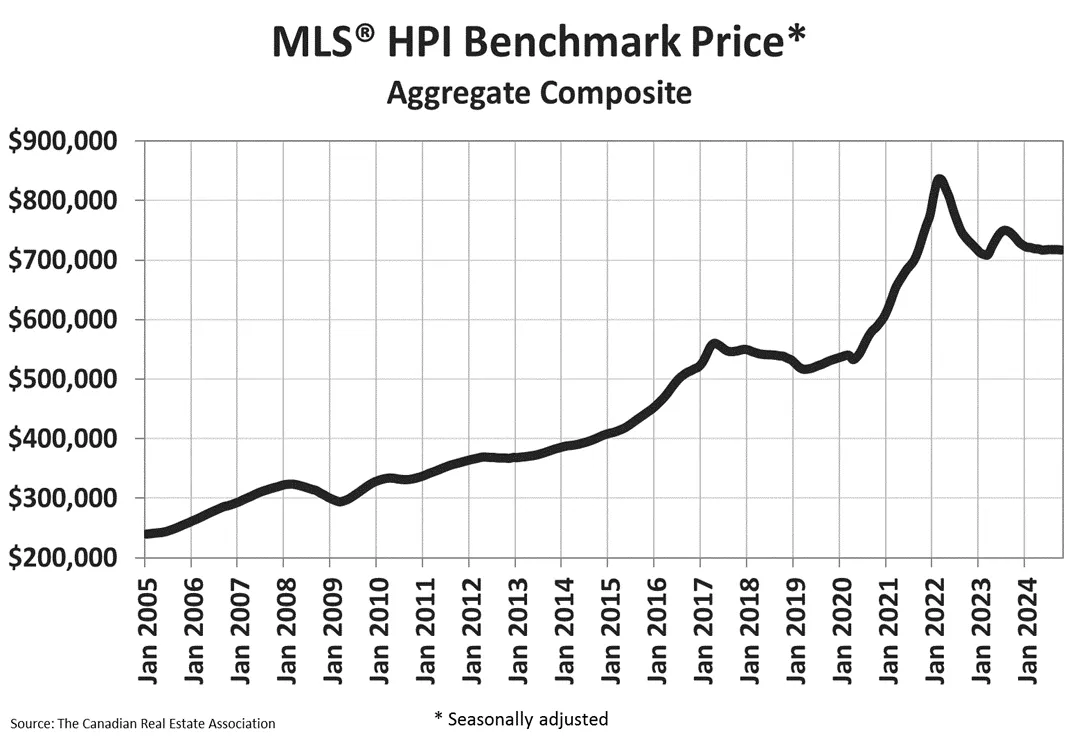

The national average home price of $696,166 in October, a 6% increase year-over-year, indicates a market gaining momentum without overheating. The marginal 0.1% month-over-month decrease in the MLS Home Price Index suggests stability, offering reassurance to buyers and sellers. The market has been relatively stable since the significant drop post rate hikes.

Economic Implications and Future Outlook

The real estate market’s performance is closely linked to broader economic factors. The Bank of Canada’s series of interest rate cuts totaling 125 basis points has significantly stimulated market activity.

While this monetary policy aims to bolster economic growth, it raises concerns about long-term inflation and housing affordability. Currently, unemployment poses a greater risk to the housing market than mortgage renewals, according to RBC’s analysis.

Looking ahead, CREA Senior Economist Shaun Cathcart suggests that the October figures could foreshadow trends in 2025. With mortgage rates potentially hitting their lows in the upcoming spring, sustained market activity might be on the horizon. However, there are some considerations:

- Supply Constraints: The availability of new listings will be vital in maintaining market momentum. A shortage of supply could lead to price hikes and affordability challenges.

- Economic Uncertainty: Factors like employment rates, inflation, and overall economic growth will continue to impact the housing market.

- Regional Disparities: Variances in performance across different Canadian regions underscore the need for localized strategies and policies.

For buyers, the current market presents…

Source link

This article was complied by AI and NOT reviewed by human. More information can be found in our Terms and Conditions.