The tech sector is currently witnessing an unprecedented resurgence, thanks to major advancements in artificial intelligence (AI) that have attracted significant investor attention.

At the forefront of these AI advancements are a small group of top-tier tech companies, collectively known as the “Magnificent Seven.” Leading the pack in the past year and a half is the semiconductor giant Nvidia (NASDAQ: NVDA), returning a whopping 628% — outperforming all other members of the Magnificent Seven.

There’s no doubt that Nvidia is playing a pivotal role in the AI revolution, with promising short-term prospects. But what about the long term?

When comparing it with other Magnificent Seven members, I believe Amazon (NASDAQ: AMZN) presents a superior investment opportunity. Let’s delve into why Nvidia is currently performing exceptionally well, and evaluate the long-term prospects of both Nvidia and Amazon.

Nvidia is on a roll, but competition is on the horizon

Generative AI applications, including training large language models, machine learning, and accelerated computing, rely on key components. These include sophisticated semiconductor chips known as graphics processing units (GPUs), and data center network services, which are essential for AI use cases.

At the moment, Nvidia sits comfortably at the crossroads of GPUs and data center operations. The company is believed to hold 80% of the market share for AI chips.

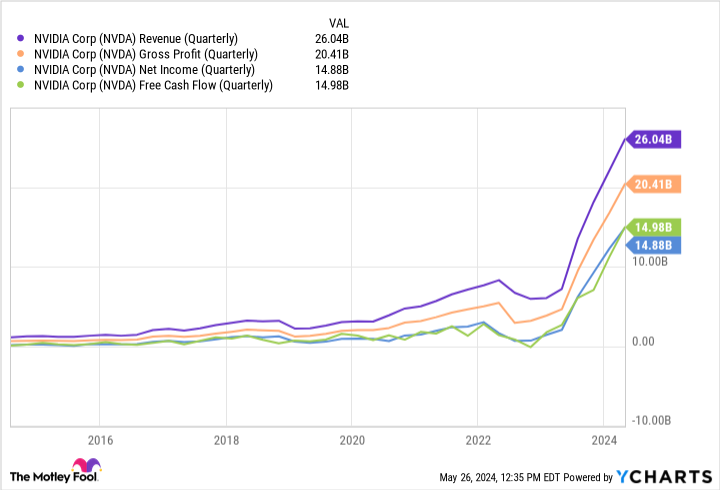

This significant market dominance has resulted in record-breaking revenue, margins, and cash flow.

The lines in the chart above highlight Nvidia’s dominance. Demand for the company’s chips and data center services is strong, giving Nvidia a powerful pricing advantage. However, Advanced Micro Devices and Intel are also working on alternative GPU solutions.

While neither company has a market share that comes close to Nvidia’s, the long-term trends driving AI suggest that they could catch up as Nvidia grapples with aligning supply output with evolving customer demand.

Additionally, Nvidia faces competition from other than chip manufacturers. Both Meta Platforms and Amazon are developing their own chips to reduce their dependence on Nvidia.

While I don’t foresee either company moving away from Nvidia in the near future, the long-term outlook suggests that some of Nvidia’s key customers may contribute less to its growth in the coming years.

Why I believe Amazon is a superior investment

Currently, Amazon is primarily recognized for its e-commerce marketplace and cloud computing infrastructure — Amazon Web Services (AWS). However, Amazon also has several other opportunities within its ecosystem, such as streaming, grocery delivery, and advertising.

This diverse business model is the main reason I’m bullish on Amazon’s long-term prospects. The company has an exceptional opportunity to expand its reach by integrating AI across all its operations.

One of Amazon’s most profitable moves to date has been its $4 billion investment in AI start-up Anthropic. Anthropic uses AWS as its primary cloud provider and is training its generative AI models on Amazon’s proprietary chips.

Furthermore, Amazon recently committed $11 billion to expand its data centers — a move that I see as a strong indication of the company’s intent to lessen its dependence on Nvidia in the long run.

While the long-term benefits of these projects are likely years away, I’m optimistic that Amazon is setting the foundation for sustained growth. On the flip side, while Nvidia is currently enjoying substantial revenue and profit growth, I’m doubtful that the company can maintain this momentum. Conversely, I believe that Amazon is just beginning to tap into a new growth wave driven by ambitious AI initiatives.

The final verdict

When deciding between Nvidia and Amazon, it’s hard to make a wrong choice. Both companies are in strong positions and present compelling investment opportunities.

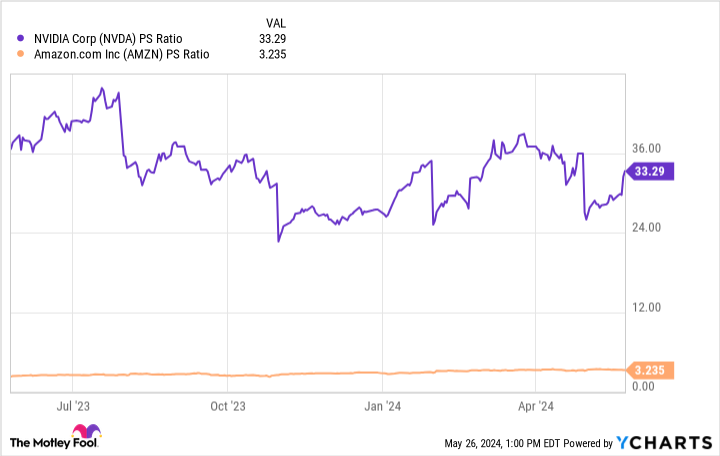

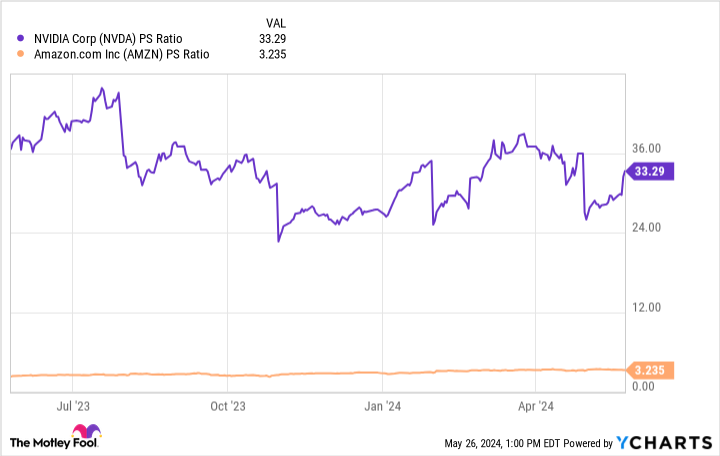

However, considering Nvidia’s stock price has surged significantly in the past few years and that competition is looming in both data center services and AI chips, I don’t foresee Nvidia maintaining its lead. Over time, I believe customers will diversify their AI infrastructure, supplementing Nvidia’s services with those from other vendors.

This shift could lead to slower revenue and profitability growth for Nvidia in the coming years. In contrast, Amazon already has over $50 billion in free cash flow and $84 billion of cash and equivalents on its balance sheet.

Amazon is in a strong financial position and has the flexibility to continue ramping up its AI efforts. As a result, I believe Amazon will eventually overtake Nvidia in terms of value as it evolves into a more sophisticated enterprise.

Given the difference in valuation multiples, I would opt for Amazon shares for the long haul. Nvidia is trading at a noticeable premium, implying some future growth may already be factored into the stock price. In my view, Amazon’s potential in the AI sector is undervalued, and its stock appears to be a bargain at the moment. I would urge investors to capitalize on this discount and keep an eye on the company’s progress.

Should you invest $1,000 in Amazon right now?

Before you decide to buy Amazon stock, consider this:

The Motley Fool Stock Advisor analyst team recently identified their 10 best stocks for investors to buy now… and Amazon wasn’t one of them. The 10 stocks that made the cut could yield substantial returns in the years to come.

For instance, when Nvidia was added to this list on April 15, 2005, a $1,000 investment at the time of our recommendation would currently be worth $671,728!*

The Stock Advisor service offers investors a straightforward blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock recommendations each month. Since 2002, the Stock Advisor service has more than quadrupled the return of the S&P 500*.

See the 10 stocks »

*Stock Advisor returns as of May 28, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Adam Spatacco has positions in Amazon, Meta Platforms, and Nvidia. The Motley Fool has positions in and recommends Advanced Micro Devices, Amazon, Meta Platforms, and Nvidia. The Motley Fool recommends Intel and recommends the following options: long January 2025 $45 calls on Intel and short May 2024 $47 calls on Intel. The Motley Fool has a disclosure policy.

This article, titled “Prediction: This “Magnificent Seven” Artificial Intelligence (AI) Stock Could Be a Better Investment Than Nvidia Over the Next 5 Years,” was originally published by The Motley Fool.

Source link

This article was complied with AI assistance and reviewed by an editor. More information can be found in our T &C