In the previous month, 36% of Greater Toronto Area (GTA) neighborhoods were in overbidding territory, a decrease from 39% in April and 43% in March, according to Wahi. This is a significant drop from the 68% recorded a year ago.

Last month, approximately 60% of GTA neighborhoods were in underbidding territory, while only 4% of homes sold for the asking price. With the recent interest rate cut by the Bank of Canada, more buyers are expected to enter the market.

“The recent rate cut by the Bank of Canada is likely to impact consumer psychology, giving homebuyers the confidence to bid on properties,” said Wahi CEO Benjy Katchen.

Wahi has observed a correlation between interest rate expectations and bidding activity. In May 2023, after consecutive rate pauses in March and April, overbidding conditions in neighborhoods increased to 68%. However, with rate hikes in June, the percentage dropped to 38% between June and July.

Different trends in single-family homes and condominiums

Wahi also noted differences in bidding activity based on property type. In the GTA market, there are opposing forces at play.

For single-family homes, row homes, and townhouses, 53% of neighborhoods were in overbidding territory last month, down from 58% in April. Conversely, only 11% of condominium neighborhoods saw sales at over-asking prices.

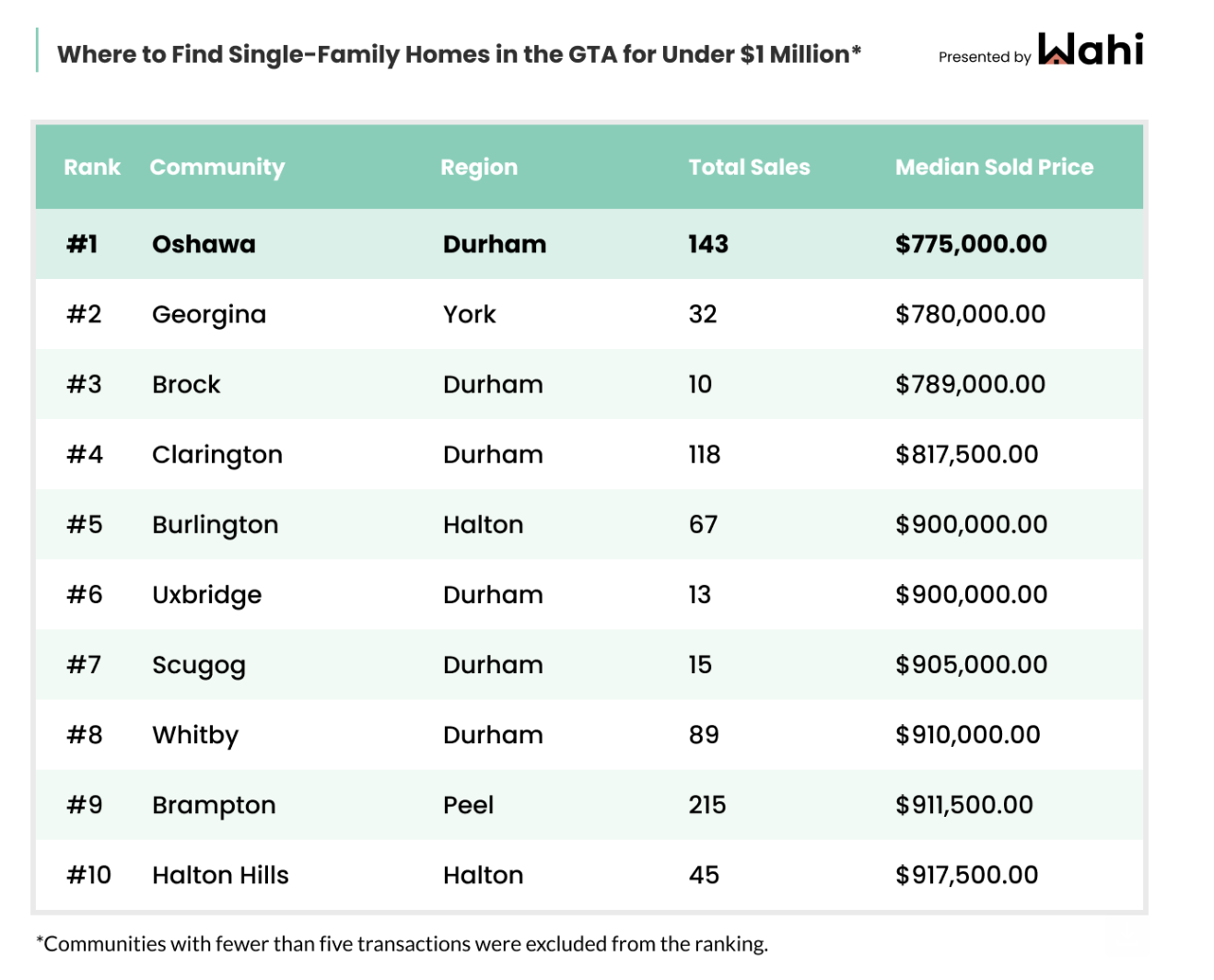

Where buyers can find GTA properties for under $1 million

In the competitive market, buyers need to be strategic and quick in their search for homes. Understanding which neighborhoods are experiencing overbidding, even in the lower price range, is crucial.

Most neighborhoods where homes sold for under $1 million were in overbidding territory, with four areas selling below the asking price. Oshawa and Halton Hills were identified as the most and least affordable areas, with median sold prices of $775,000 and $917,500, respectively.

Read the full analysis here.

Source link

This article was complied with AI assistance and reviewed by an editor. More information can be found in our T &C