A lukewarm attempt at recovery seems to be appearing in Toronto’s real estate market. For the first time in a while, it seems that demand has been able to outgrow supply.

According to October data from the Toronto Regional Real Estate Board, active listings are still up significantly (25.3 per cent) but sales are up more (44.4 per cent).

Source: TRREB

I won’t dispute that the general sentiment in the real estate market in the Greater Toronto Area does seem to be warming up a little, with home sales up compared to October of last year. Frankly, I’d be very concerned if we didn’t see some warmth, given we’ve seen significant advantages given to buyers since then, including:

- Interest rates coming down 125 basis points

- Amortizations will be extended to 30 years, increasing buying power by 8 per cent

- Insured mortgage cutoff increasing from $1-million to $1.5-million

- Neighbourhoods have been upzoned to four units

- The government has created incentives for owners who want to add units

Warm, not hot

I deliberately chose the word “warm” because it has been pretty cold all year, and I’m not ready to describe it as “heating up.” In the past few months, new listings were up significantly, and the heightened pace of supply caused active listings to accumulate more quickly against suppressed demand.

This month, new listings are only up 4.3 per cent compared to last year, which could dramatically slow the pace at which active supply accumulates. If sales remain strong toward the end of the year we could see some supply get absorbed and momentum build for a more pronounced spring market. As mentioned in earlier notes, rate cuts seem to be more of a pent-up supply story than a pent-up demand story so far—with sellers timing the “heating” effect just as much as buyers.

Buyer’s vs seller’s market

Homes are still selling more slowly than they did last year, now spending 28 to 30 per cent more time on the market compared to last year. This means that supply takes longer to get absorbed, and the market will definitely need to speed up its absorption rate if it hopes to see a seller’s market in the next spring. To me, our current reading on “days on market” metrics indicates a market that is balanced, or even leaning in favour of buyers, rather than sellers.

Condos

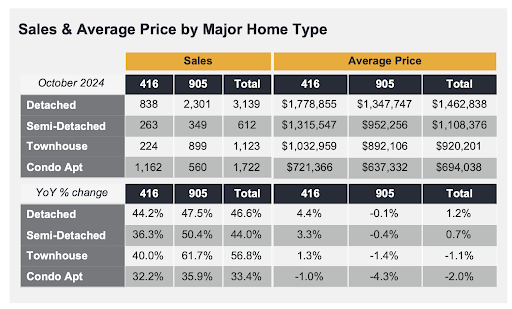

No supply/demand imbalance has been more pronounced than the 416 condo sector. As a result, looking at the 416 condo sector can often tell us a lot about the market. In the past few months, year-over-year growth in condo sales has been relatively low or negative, but in October, condo sales posted pretty significant gains. 32.2 per cent more 416 condos sold this October than last October, and similarly, 35.9 per cent more 905 condos sold.

It is reasonable to assume that the returning affordability brought on by falling interest rates and falling condo prices has helped make these units more attainable for entry-level buyers, downsizers, and investors. Toronto condo prices have fallen 1 per cent since last year (a drop of about $7,200), while 905 condos have fallen 4.3 per cent since last year (a drop of about $27,000).

Source: TRREB

Detached homes

Detached homes have been a different story altogether. In the 416 area, detached homes are up 4.4 per cent, likely supported by upzoning to 4 units, and anticipatory demand from increased insurable mortgages and longer amortizations ahead. The knock-on effect appears in increases we’re seeing in semi-detached and townhouse products, up 3.3 per cent and 1.3 per cent respectively.

905 versus 416

This month’s data really paints the picture that we’re seeing a re-urbanization of demand. With a re-opening workplace and Toronto’s traffic being ranked third worst in the world, it is not surprising that those who suburbanized into the 905 during the pandemic era may be reconsidering a 416 lifestyle.

This trend is most visible when looking at the sale-to-list-price ratio (SP/LP) in suburban areas, like Simcoe County and Peel Region, versus urban 416 areas:

- (905) Halton Region – 98 per cent

- (905) Peel Region – 98 per cent

- (416) City of Toronto – 100 per cent

- (905) York Region – 98 per cent

- (905) Durham Region – 100 per cent

- (705) Dufferin County – 98 per cent

- (705) Simcoe County – 97 per cent

From my view, the sale-to-list-price ratio acts like a bid/ask spread indicator—where a narrower spread indicates a more efficient and liquid market. In real estate terms, a sale-to-list price ratio closer to 100 per cent suggests a more balanced market where buyers and sellers are in closer agreement on property values. When this ratio is significantly below 100 per cent, it often indicates a buyer’s market where properties are selling for less than their list price. Conversely, when it’s above 100 per cent, it typically signals a seller’s market where properties are selling for more than their asking price due to high demand.

Looking…

Source link

This article was complied by AI and NOT reviewed by human. More information can be found in our Terms and Conditions.