In a shift that could reshape Canada’s housing market, the Office of the Superintendent of Financial Institutions (OSFI) is considering replacing the controversial mortgage stress test with a new portfolio-level approach to risk management.

This potential change marks a fundamental transformation in how Canada regulates mortgage lending, moving from individual borrower qualification to institutional portfolio management.

Source: Valery.ca

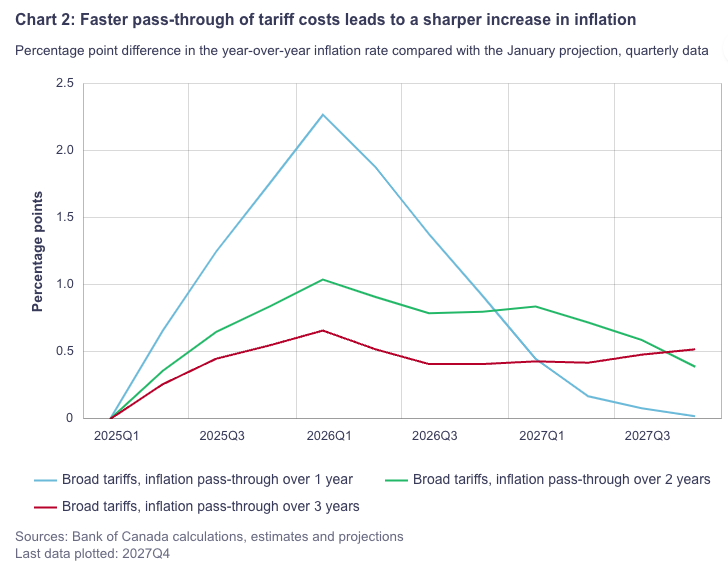

In retrospect, while the stress test appears to have achieved its initial objective of protecting Canada’s financial system during the period of low interest rates, the current economic landscape presents new challenges. With emerging inflationary pressures from potential trade wars and tariffs, combined with Scotiabank’s recent analysis suggesting limited room for the Bank of Canada to implement significant rate cuts, we’re entering uncharted territory.

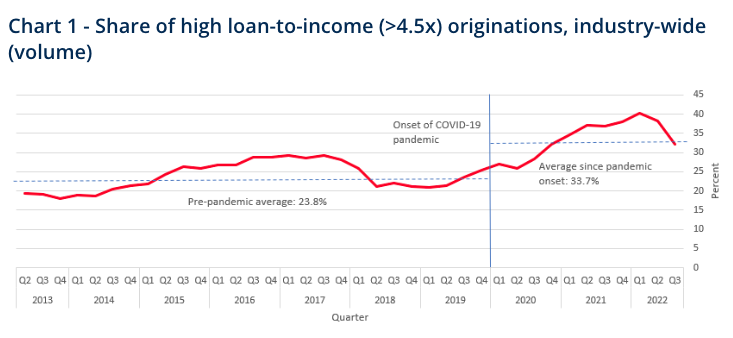

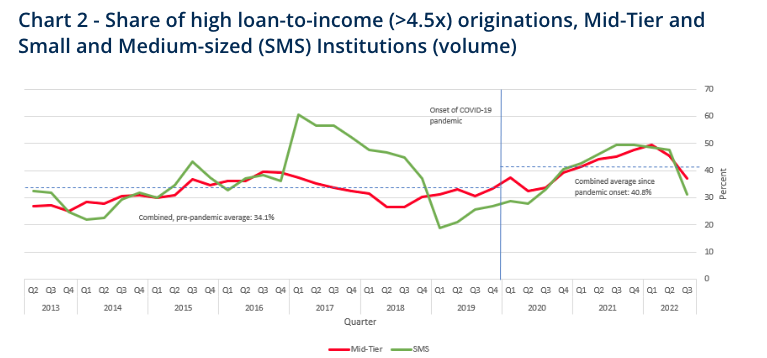

These charts from OSFI show the positive impact of the stress test, although the risk shifted to medium-sized lenders for a short period of time to backfill the demand.

The current landscape

Since its introduction in 2016 and subsequent expansion in 2018, the mortgage stress test has been both praised as a prudent safeguard and criticized as an unnecessary barrier to homeownership. Under current rules, borrowers must qualify at either 5.25 per cent or their contract rate plus 2 per cent, whichever is higher—a requirement that has significantly impacted purchasing power across the market.

The effectiveness of the stress test during the 2022-2023 rate hikes is evident in the relatively low default rates. However, the potential for persistent inflation driven by trade tensions could keep interest rates higher for longer than initially anticipated, potentially requiring a more nuanced approach to mortgage regulation.

This evolving economic environment may justify OSFI’s proposed shift to portfolio-level risk management, as it could provide more flexibility in responding to complex market conditions where both inflation and financial stability concerns need to be balanced. The challenge will be implementing a system that can adapt to these new economic realities while maintaining the protective benefits the stress test provides.

Bank of Canada’s thoughts on how tariffs could show up in Canadian inflation

The new direction

OSFI’s proposed alternative represents a sophisticated evolution in regulatory thinking. Instead of testing individual borrowers against hypothetical higher rates, the new approach would limit banks’ overall exposure to high-risk lending. Specifically, banks would be restricted to issuing no more than 15 per cent of their quarterly mortgages to borrowers whose mortgage debt exceeds 450 per cent of their annual income.

Why this matters

This shift is more than just a technical adjustment—it’s a fundamental rethinking of how we manage housing market risk. The current stress test, while well-intentioned, has been criticized for creating artificial barriers while failing to prevent the accumulation of high debt loads. OSFI’s own analysis reveals that despite the stress test, many borrowers continued to secure mortgages exceeding 450 per cent of their household income.

The historical context

Canada’s cautious approach to mortgage regulation isn’t without reason. The 1982 housing crash led to the collapse of 36 federally insured loan and trust companies and two banks, requiring $1.3-billion in government deposit insurance payouts. This history of market corrections tied to weak lending rules continues to influence regulatory thinking.

Market implications

The proposed changes could have far-reaching effects on Canada’s real estate market:

- Portfolio management: Banks will need to carefully balance their mortgage portfolios, potentially leading to more strategic lending practices.

- Market access: Some borrowers might find it easier to qualify for mortgages, while others might face new challenges based on their debt-to-income ratios.

- Risk distribution: The approach shifts responsibility for risk management from individual borrowers to financial institutions.

The broader economic picture

This regulatory evolution comes at a crucial time for Canada’s housing market. With concerns about affordability reaching critical levels and economic uncertainties affecting specific sectors (as evidenced by recent restrictions on lending to steel and aluminum workers), the timing of these changes could significantly impact market dynamics.

Looking ahead

OSFI’s careful approach—including a full year of assessment before making a final decision—reflects the complexity and importance of this potential change. The regulator must balance the need for market stability with the goal of maintaining a healthy, accessible housing market.

The next chapter

As we await OSFI’s final decision, one thing is clear: Canada’s approach to mortgage…

Source link

This article was complied by AI and NOT reviewed by human. More information can be found in our Terms and Conditions.