Saint John, New Brunswick (Canva)

Don’t miss out—join us for REM’s first monthly market breakdown webinar on Feb. 25 at 2 PM Eastern. Hosted by REM, columnist Daniel Foch will dive into CREA’s latest stats and key market trends. Have questions? Leave them in the comments or send them in advance to editor@realestatemagazine.ca. Register now.

Something has shifted in Canada’s housing market. This shouldn’t come as a surprise, given something has certainly shifted at a global geopolitically level. You might even call it a “tarrifying” headwind for Canada’s real estate market.

For years, supply was tight, and homebuyers outnumbered sellers in Canada’s real estate market. But as 2025 begins, the landscape looks strikingly different. New listings are pouring into the market at an extraordinary pace, while sales are faltering under the weight of mounting economic uncertainty.

As is tradition, when facing an unknown future, Canada’s real estate market has decided to hit the “pause button.” It is not uncommon to see the market take a breath when we’re facing a historic election, a pandemic or a changing economy. Today’s trade war is no different.

Compounding the turbulence, President Trump’s proposed tariffs on Canadian exports loom over key industries, raising concerns about potential job losses, wage stagnation, and the broader impact on housing demand. Though the Canadian-specific targeting has been temporarily postponed, Trump’s global target on steel and aluminum has Canada written all over it.

A historic surge in listings, a slowdown in sales

For buyers willing to stomach the risk, this could be the window of opportunity they’ve been waiting for—more choices and lower interest rates make financing more attractive. But for sellers, it’s a wake-up call. A market that once favoured them is now shifting toward balance—or even softness in some areas. Yet, the full impact of these shifting dynamics remains uncertain, as much depends on the outcome of the postponed tariffs and their potential ripple effects across the economy.

CREA’s January market data gives us a clearer picture of what’s ahead. Let’s break it down.

Unprecedented inventory growth

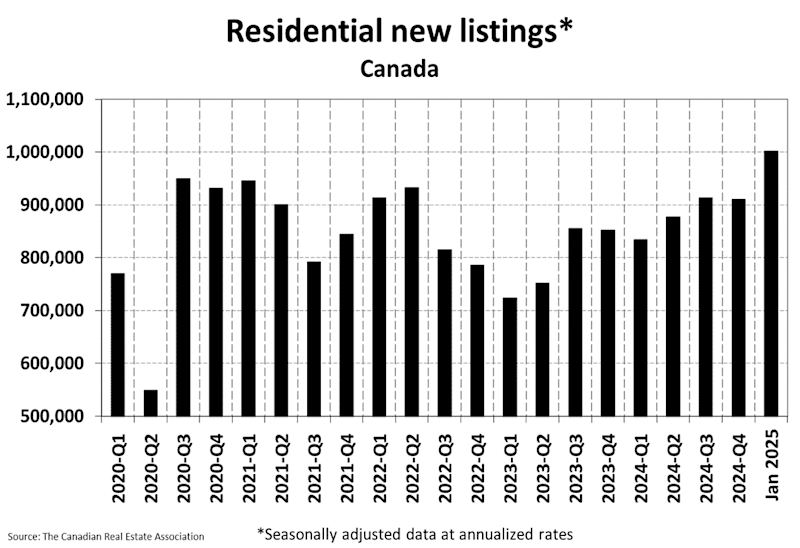

One of the biggest surprises of early 2025 has been the flood of new listings. Figures for January reveal that new supply jumped 11 per cent compared to December 2024—the largest seasonally adjusted increase since the late 1980s (excluding pandemic-era fluctuations).

What does this mean? It’s a clear sign that more homeowners are choosing to sell, possibly in anticipation of weaker market conditions. In high-priced regions like British Columbia and Ontario, where supply had been tightening in 2024, this sudden increase in listings is cooling price pressures and shifting negotiating power back toward buyers.

Sales take a hit amid economic jitters

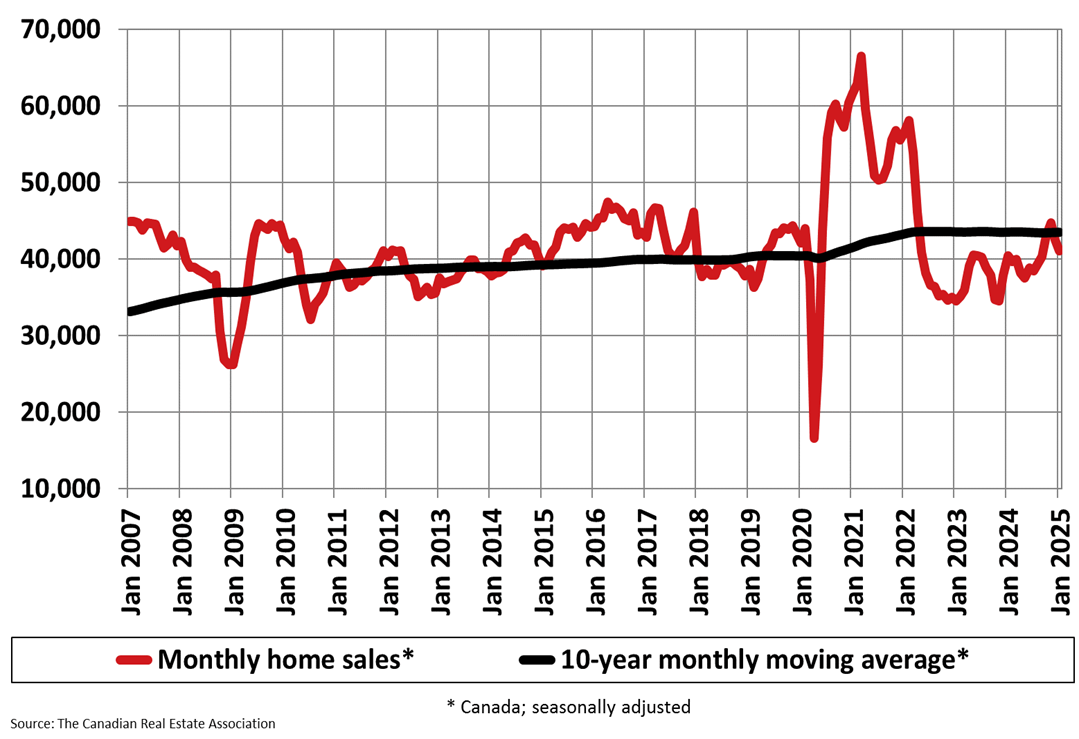

While inventory rose, sales did not follow suit. Instead, national home sales fell 3.3 per cent month-over-month, with the most dramatic drop occurring in the last week of January. The timing suggests that buyers pulled back due to growing concerns over Trump’s tariff policies, which many fear could destabilize Canada’s economy.

However, it’s not all bad news. Compared to January 2024, actual sales were up 2.9 per cent, meaning demand is still present—just hesitant. Buyers aren’t disappearing, but they are waiting to see where the economy lands before making big moves.

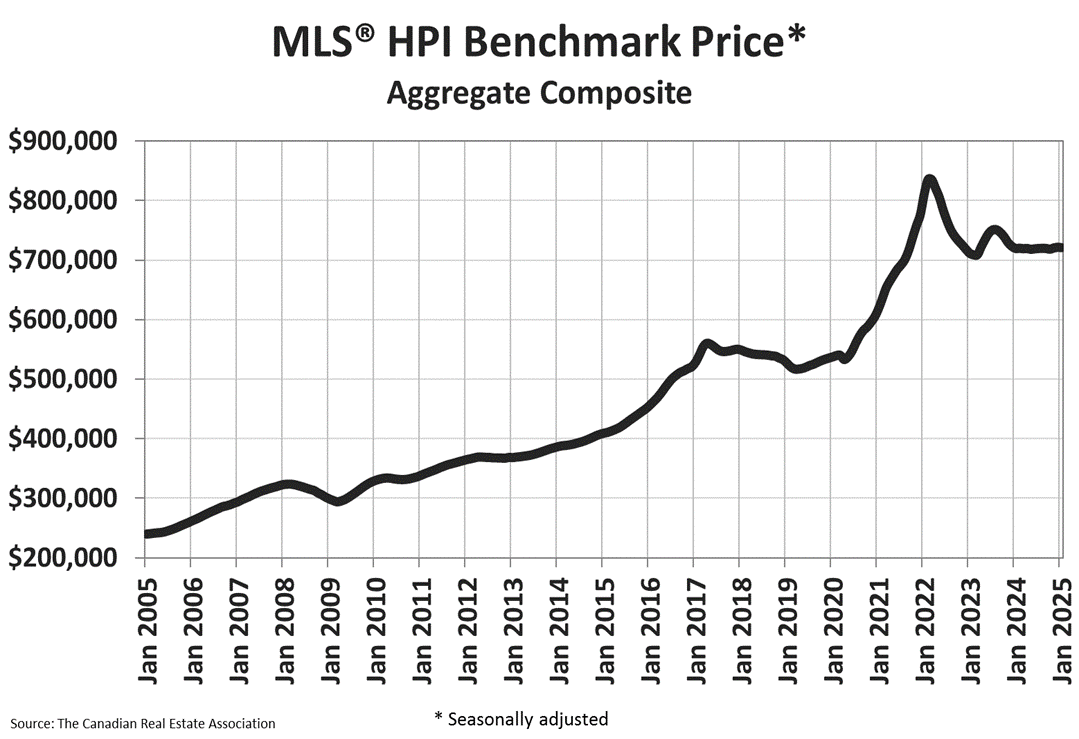

Prices hold their ground—for now

Despite rising inventory and weaker sales, home prices have remained surprisingly stable:

- The MLS Home Price Index (HPI) barely changed month-over-month (-0.08 per cent) and year-over-year (+0.07 per cent).

- The national average home price hit $670,064, up 1.1 per cent from January 2024.

But not all regions are experiencing the same trends:

- British Columbia and Ontario: A surge in supply is creating a softer pricing environment, making these regions more favourable for buyers.

- Alberta and Saskatchewan: With inventories at near 20-year lows, prices continue to rise despite economic uncertainty.

- Quebec and Atlantic Canada: These markets are expected to see both price and sales growth in 2025, making them the country’s most balanced housing sectors.

The big unknown

A game-changer for the Canadian economy

Just as Canada’s housing market was poised for recovery, a new storm appeared on the horizon: Trump’s tariff policy for Canada.

The U.S. government has proposed a 25 per cent tariff on all Canadian non-energy exports and a 10 per cent tariff on Canadian energy exports, though implementation has been postponed by 30 days. If implemented, this policy shift could disrupt key industries, hamper trade and increase the risk of an economic downturn.

Some cities will feel the effects more than others. New research from the Canadian Chamber of Commerce’s Business Data Lab has identified the regions most vulnerable to these tariffs….

Source link

This article was complied by AI and NOT reviewed by human. More information can be found in our Terms and Conditions.