This morning, the Bank of Canada (BoC) surprised the market by announcing a 50 basis point (bps) cut in its benchmark interest rate, bringing it down from 4.25 per cent to 3.75 per cent. As homeowners and potential buyers digest this news, the primary question on many minds is how this will impact mortgages, real estate, inflation and the broader economy.

Here’s a breakdown of what the rate cut could mean, with a focus on the housing market, mortgage renewals and the wider financial landscape.

Why a rate cut might not be all good news

At first glance, the BoC’s 50 bps rate cut might seem like positive news for borrowers. Lower interest rates generally translate to cheaper borrowing costs, which could help prospective homeowners and businesses. However, such a rate cut may not be a sign of economic health.

Often, when central banks cut rates significantly, it’s because they anticipate economic challenges ahead. In this case, the rate cut could signal concerns about a looming slowdown or potential recession in Canada. A recession could lead to deflationary risks for some parts of Canada’s economy, and when consumers feel prices are falling, they stop spending and wait for better prices. This fear is especially real outside of the housing market.

Within the housing market, we see that shelter inflation is a primary contributor to inflation in Canada, according to the BoC’s recent Monetary Policy Report, released with today’s interest rate cut. This inflationary pressure from rent and mortgage interest costs can be observed below in the CPI component breakdown. Especially worth noting is that “House price related services” have been ice-cold for the better part of two years now. Realtor commissions remain at historic lows, and the BoC could be gaining confidence that the market will not overheat in response to rate cuts.

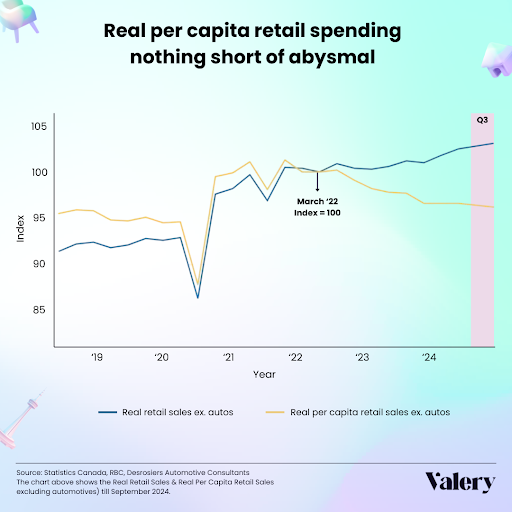

Though the lower rate will reduce the cost of borrowing, it also suggests that the BoC is attempting to stimulate a flagging economy. While homeowners may see some relief in their monthly payments, this could be overshadowed by rising unemployment or weaker economic activity if a downturn materializes. RBC noted this reality very directly in a recent brief that characterized retail spending as “abysmal”:

Effect on inflation due to mortgage renewals

While the BoC has cut its interest rate, inflation continues to be a concern, partly due to mortgage renewals at higher rates. Tiff Macklem, the BoC’s governor, mentioned they’re equally concerned about the risk of deflation and inflation. If we don’t see further reduction, mortgage rates could keep upward pressure on inflation into 2025 and 2026.

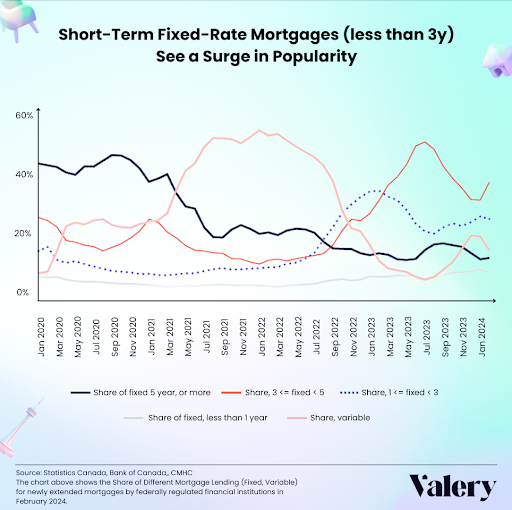

From mid-2020 to early 2022, Canadian mortgage rates were exceptionally low, prompting a surge in both new mortgages and refinances. As a result, a large proportion of these mortgages — about 60 per cent — are set to renew in 2025 and 2026. With today’s overnight rate now standing at 3.75 per cent, homeowners renewing their mortgages will face significantly higher payments than they did during the era of 0.25 per cent overnight rates.

This situation has indirect implications for inflation. Higher monthly mortgage payments reduce disposable income for other goods and services, potentially slowing consumer spending and easing some inflationary pressure. However, the “base effect” comes into play, as the shift from historically low interest rates to the current elevated levels still poses a financial strain for many households. Even with the recent cut, the elevated rates for renewed mortgages will continue contributing to inflationary pressure in the Canadian economy — particularly through rising housing costs.

Bond yields control fixed-rate mortgages, not the BoC

A common misconception is that the BoC directly controls all mortgage rates. While it does influence variable mortgage rates, the majority of Canadians who opt for fixed-rate mortgages are affected more by bond yields than by the BoC’s overnight rate. Fixed-rate mortgages are very popular and closely tied to the performance of government bonds, especially the five-year one, which has been on a declining trend since April 2024.

As it stands, the bond market seems to be pricing in fewer cuts in the future, though there’s likely a bit of myopia toward the market as a result of the United States election. The market likely doesn’t anticipate any significant actions from the Federal Reserve prior to the election, as it could become too politicized. (In fact, it already seems to be.)

This means that we’ll likely need to wait until the U.S. election is over for a real idea of what will happen with bond yields and interest rates in 2025. To get an understanding of this, it’s very important to think about how the BoC monitors Federal Reserve activity.

The importance of U.S. Federal Reserve decisions

In light of the BoC’s 50 bps cut, the interplay between Canadian and…

Source link

This article was complied by AI and NOT reviewed by human. More information can be found in our Terms and Conditions.