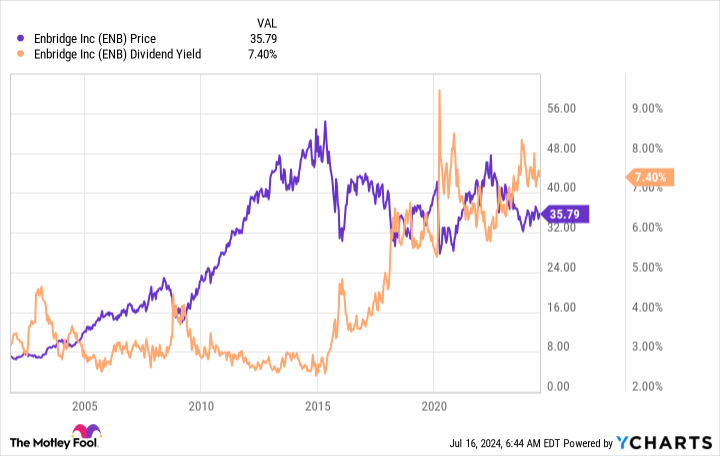

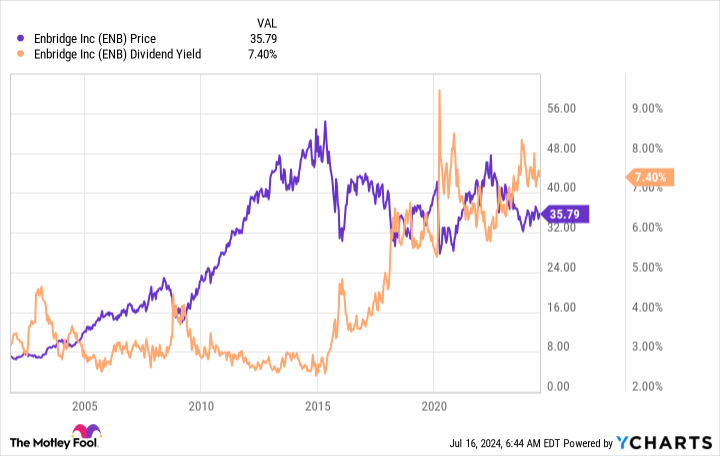

Enbridge (NYSE: ENB) is not a flashy company, but that’s part of its appeal. With an impressive dividend yield of approximately 7.4%, there are solid reasons why investing in this stock now could pay off in the long run. To truly understand the value Enbridge offers to investors over time, it’s important to delve deeper into its business operations.

Enbridge’s Diverse Business Model

The energy sector is known for its volatility, but not all companies within the industry experience the same level of instability. While upstream and downstream businesses can be unpredictable, midstream companies like Enbridge tend to be more stable. This is because midstream companies own the infrastructure that transports energy resources, such as pipelines, and generate revenue through fees for the use of these assets.

Enbridge essentially acts as a toll collector in the energy market. Given the essential nature of oil and natural gas, demand for their transportation remains robust even during periods of low energy prices. Oil pipelines contribute around 50% of Enbridge’s earnings before interest, taxes, depreciation, and amortization (EBITDA), while natural gas pipelines make up approximately 25% of the total. Additionally, regulated natural gas utilities (22% of EBITDA) and investments in renewable energy (3%) further diversify Enbridge’s revenue streams.

Regulated utilities, in particular, provide stable growth opportunities, as they operate in monopolistic environments with government oversight. Enbridge’s foray into renewable energy reflects a strategic move towards cleaner energy sources, positioning the company for future market trends.

Investor Outlook on Enbridge

While Enbridge may not be the most exciting investment, its reliable dividend yield of 7.4% offers a compelling value proposition. With a strong balance sheet and a consistent track record of dividend increases over 29 years, Enbridge is a dependable income stock with modest growth potential.

Potential Upside for Investors

Despite its stable business model, Enbridge’s current high dividend yield suggests that the stock may be undervalued. If market sentiment towards the company improves, investors could benefit from capital appreciation in addition to the attractive dividend yield. While Enbridge may not offer rapid growth, its consistent performance and income generation make it a compelling long-term investment.

Is Enbridge a Good Investment?

Before making any investment decisions, it’s important to consider the potential risks and rewards associated with Enbridge. As a reliable dividend stock with steady growth prospects, Enbridge offers investors a solid income opportunity. By reinvesting dividends, investors can benefit from compounding returns over time, making Enbridge an appealing choice for those seeking stability and income in their investment portfolio.

Source link

This article was complied with AI assistance and reviewed by an editor. More information can be found in our T &C