Typically, a dividend raise from a large-cap stock isn’t very massive. Such companies typically have a great many shares outstanding, so even a modest hike in the shareholder payout could mean additional expenses of millions, possibly even billions, of dollars. So for the most part, whenever one of these titans declares a dividend raise, it’s more of a bump than a jump.

That sure wasn’t the case with telecom T-Mobile US (NASDAQ: TMUS) earlier this month, when it enacted a 35% dividend raise. That’s quite the generous hike; let’s take a closer look at it and figure out if it helps make the stock a buy.

Improving results and a FCF windfall

In mid-September, T-Mobile’s board of directors declared that its upcoming quarterly dividend is to be $0.88 per share. That was surely pleasing to shareholders who had previously earned a payout of “merely” $0.65. For investors who like to take advantage of such situations, there’s still plenty of time to hop on this dividend raise, as it is going to be paid on Dec. 12 to investors of record as of Nov. 27.

T-Mobile is likely feeling flush because its cash waterfall is flowing robustly. Scrolling through its second-quarter earnings release from the end of July, one line item stands out sharply — non-GAAP (adjusted) free cash flow (FCF). At $4.4 billion, this was a whopping 54% higher year over year and notched an all-time high for the company. Other financial metrics rose nicely, but not as steeply, with its core services revenue advancing 4% to $16.4 billion, and headline net income increasing a chunky 32% to $2.9 billion.

FCF growth is the motor that drives dividend raises, hence the company’s confidence in boosting the payout more than one-third higher. T-Mobile has actually had quite a bit of gas in the tank for raises even before the second-quarter FCF pop, as the quarterly spend on its few rounds of dividends — it only initiated its payout at the end of 2023 — was $769 million at most.

Happily for the company’s shareholders, management raised its FCF guidance for full-year 2024. This should help management meet its goal of roughly 10% annual dividend growth.

Playing catch-up

T-Mobile management might feel it’s in catch-up mode. After all, the two rivals it’s always compared to — Verizon Communications and AT&T — have been steady and reliable dividend payers for years. Not only that, but the pair long ago wandered into high-yield dividend territory and stayed there (despite significant changes in corporate structure, as in AT&T’s case). Verizon keeps its investors sweet with a payout that yields over 6%, while AT&T isn’t far behind at 5.1%.

Although ever-scrappy T-Mobile’s 35% raise is impressive on a number of levels, even at the enhanced new level its distribution would only yield 1.7%.

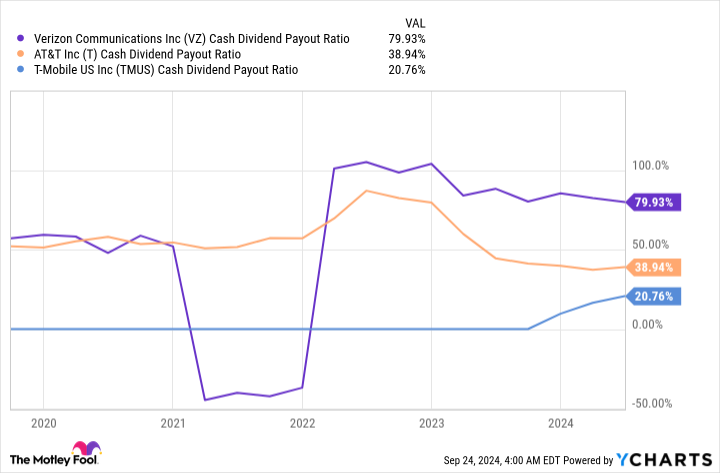

But we can expect this difference in yields to narrow before long, assuming T-Mobile keeps roaring along. Taking a glance at its cash dividend payout ratio — that’s the percentage of FCF it devotes to those dividend payouts — reveals a notably lower figure than that of AT&T or (especially) Verizon:

VZ Cash Dividend Payout Ratio data by YCharts

Meanwhile, in next-generation mobile technology T-Mobile is better positioned than its two peers. It has managed to build out its 5G infrastructure to the point where it’s a leader; according to a July analysis from telecom researcher OpenSignal, the company is “untouchable” for 5G availability, with T-Mobile 5G service subscribers connected to the tech almost 68% of the time when online. That percentage is nearly six times that of AT&T, and roughly nine times the rate of Verizon.

In fact, of the 15 categories tracked by OpenSignal, T-Mobile took the gold in nine of them, including 5G coverage experience and consistency of quality.

AT&T and Verizon are clearly determined to close these gaps, but 5G isn’t cheap or easy to build out. AT&T plans to spend $11.5 billion to $12.5 billion throughout the second half of this year on capital expenditures, and you can bet large chunks of that are being poured into 5G. In the same period last year, AT&T’s outlays totaled $11.2 billion. Verizon is also spending more, to the tune of $8.9 billion to $9.4 billion against second-half 2023’s $8.7 billion. Is it any wonder that the two are heavily indebted?

Make no mistake, T-Mobile has to spend to earn, too, but its burden isn’t nearly as burdensome. The company estimates its second-half capex will come in at $4.2 billion, up from $4 billion in the year-ago period.

So in short, T-Mobile operates in a business considered indispensable to many consumers, it’s improving its fundamentals effectively while not being as weighed down by spending goals as others, and it has a dividend with room to grow at inspiring rates. All that makes its stock rather compelling, in my opinion.

Should you invest $1,000 in T-Mobile US right now?

Before you buy stock in T-Mobile US, consider this:

The Motley Fool Stock Advisor analyst team just identified what…

Source link

This article was complied by AI and NOT reviewed by human. More information can be found in our Terms and Conditions.