3dotsad/iStock via Getty Images

Real estate stocks soared this week after inflation data increased bets in favor of a Federal Reserve rate cut in September, while the earnings season kicked off on a positive note for the markets.

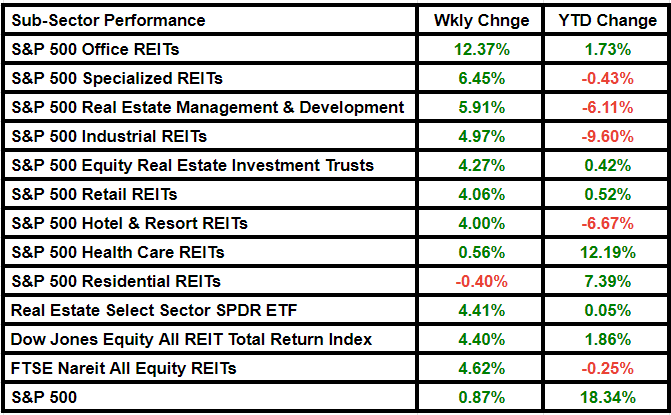

The stocks saw the biggest jump among all the S&P 500 sectors, with The Real Estate Select Sector SPDR ETF (NYSEARCA:XLRE) closing the week 4.41% higher at 39.99. The ETF saw the largest climb on Thursday, of 2.66% to 39.70.

According to the U.S. Bureau of Labor Statistics’ report on Thursday, the Consumer Price Index edged down 0.1% M/M in June, less than the 0.1% increase expected and the 0.0% figure in May.

“Shelter inflation moderates to 0.2% M/M, which brings the core CPI to 0.1% M/M below expectations,” notes SA Analyst Damir Tokic. “This is a positive trend, if it continues.”

“Overall, the Fed will need more evidence that shelter is moderating, but the June CPI data does increase the probability of the September cut,” said Tokic.

Meanwhile, the producer price index heated up more than expected in June after its May dip. The probability of a 25-basis-point cut in September now stands at 90.3% from 69.7% on Wednesday, according to the CME FedWatch tool. Out of a total of 987 responses from Seeking Alpha’s July Sentiment Survey, the majority – 44.3% or 437 – said the first rate cut will happen during the month.

On the other side, financial stocks rose 1.9% during the week that saw some of the country’s biggest banks report their Q2 earnings, outpacing the broader S&P 500’s 0.87% gains.

The Dow Jones Equity All REIT Total Return Index rose 4.40% from last week, while FTSE Nareit All Equity REITs added 4.62%.

Earnings season

Crown Castle (CCI), Prologis (PLD), SL Green Realty (SLG) and First Industrial Realty Trust (FR) are the major real estate names reporting quarterly earnings next week.

The sector is estimated to post a 2.5% decline in Q2 earnings, but a 6.8% growth in revenue, a July 5 S&P 500 earnings scorecard from the London Stock Exchange said. The S&P 500 real estate companies are expected to post combined earnings of $12.04B and revenue of $39.6B.

SA’s Quant Rating system rates Host Hotels & Resorts (HST), Realty Income (O) and Kimco Realty (KIM) as top picks in the sector ahead of the Q2 earnings season.

Quant assigns XLRE a Sell rating, with a score of 2.47 on a scale of 5. SA analysts grade the fund as Hold.

The ETF saw net outflows worth $1.85M last week, compared to $168.94M a week ago, data from the information solutions provider VettaFi showed.

Notable movers

BXP’s (BXP) 12.37% weekly gain led the office subsector to emerge a winner for the week among subsectors.

Telecom tower REIT SBA Communications (SBAC), real estate company CBRE Group (CBRE) and health care REIT Alexandria Real Estate Equities (ARE) were the other notable gainers.

Health care REIT Welltower (WELL) and residential REITs Invitation Homes (INVH) and UDR (UDR) were significant losers.

Apartment REITs dropped after a media report on the U.S. Justice Department working on a lawsuit against a software company. The company provides recommendations to landlords on how much rent to charge using confidential information from its clients.

Logistic Properties of the Americas (LPA), Peakstone Realty Trust (PKST) and Opendoor Technologies (OPEN) were the noteworthy winners of the broader real estate sector.

Here is a look at the S&P 500 real estate subsectors performance:

Source link

This article was complied with AI assistance and reviewed by an editor. More information can be found in our T &C