In Canada, real estate has long been more than a roof over one’s head. It’s been a store of wealth, a retirement strategy, a family legacy—and increasingly, a fault line in intergenerational fairness. The gap between the haves and have-nots is often measured in property lines, and the 2025 federal election will reflect that tension.

Over the past two decades, housing affordability has become a defining issue for Canadians. For many younger voters, homeownership feels further away than ever. For older investors, property has been a financial windfall. Housing is no longer just a policy issue—it’s a political one.

Each major party—the Conservatives, Liberals, and NDP—has put forward a vision to fix Canada’s housing system. These proposals differ in tone, execution, and economic philosophy.

Source: Valery.ca

Conservatives: Unlocking trapped wealth to fuel growth

A tax deferral to get capital moving again

The Conservative Party’s “Canada First Reinvestment Tax Cut” targets the enormous capital tied up in real estate and other assets. Under this plan, individuals and businesses could defer capital gains taxes on the sale of these assets if the proceeds are reinvested into active Canadian businesses.

Unlike traditional tax cuts, this proposal doesn’t forgive taxes—it delays them until the new investment is sold or moved offshore. It’s intended to redirect passive wealth into more productive sectors.

Inspired by the U.S. 1031 exchange—but broader

This plan echoes the U.S. 1031 exchange, which allows real estate investors to defer capital gains taxes by rolling over proceeds into new properties. But the Canadian version expands this idea beyond real estate. Investors could cash out of property and reinvest in sectors like tech, clean energy, or manufacturing.

Implications for investors and sellers

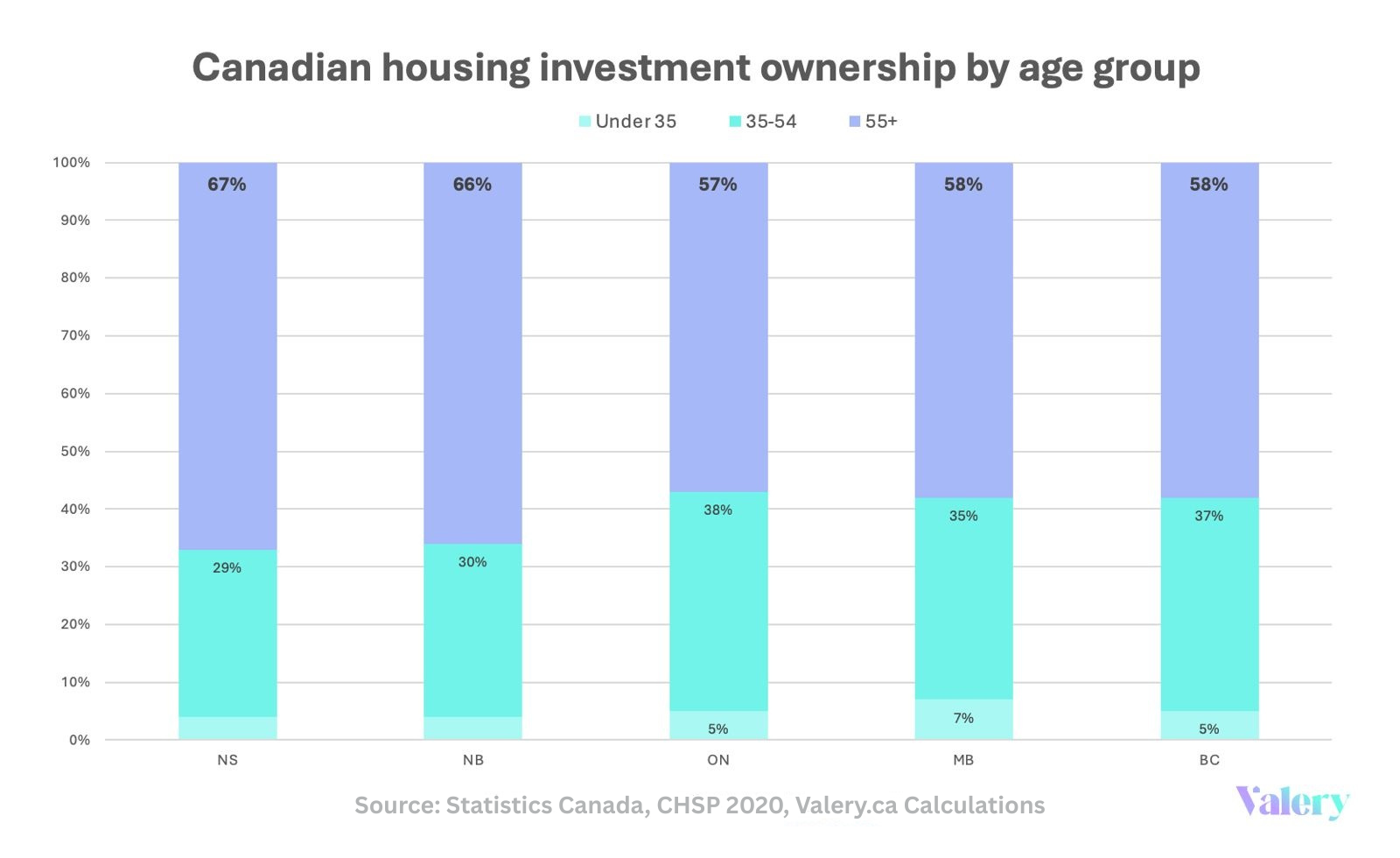

For real estate investors, especially those aged 55 and older— who make up the majority of investment property owners in provinces like Ontario, B.C., and Nova Scotia, according to Statistics Canada—this proposal could offer a strategic and tax-efficient way to exit the market. By deferring capital gains taxes, it provides an incentive to sell long-held properties without facing an immediate tax hit, potentially unlocking significant housing supply. That shift could ease pressure in tight markets, boost listing volumes, and redirect dormant capital into more productive sectors of the Canadian economy.

Source: Valery.ca

It’s also a subtle bet: that Canadian investors, if given the choice, would rather reinvest in the national economy than park their wealth abroad—a trend already visible in 2024 when Canadians ranked as the top foreign buyers of U.S. real estate.

Source: Valery.ca

Liberals: Building at historic scale

Build Canada Homes (BCH) Proposal: Doubling supply ambitions

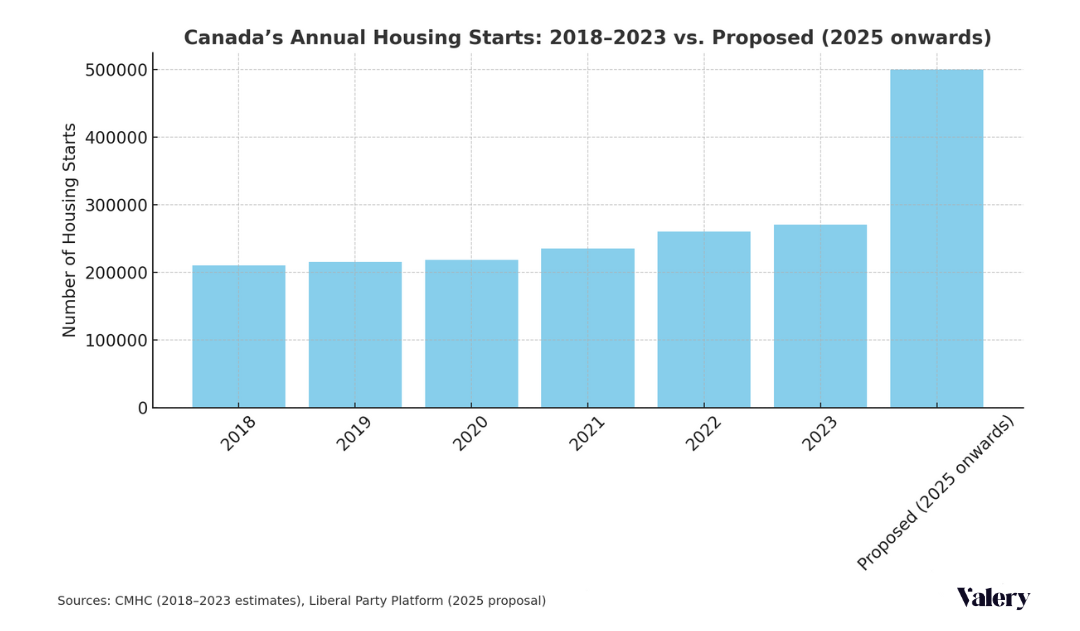

Under the leadership of Mark Carney, the Liberal Party’s Build Canada Homes (BCH) proposal outlines a plan to double Canada’s annual housing output to 500,000 homes. This represents a level of direct government involvement not seen since the post-war era.

The chart below puts this ambition in perspective by comparing the proposed target to actual housing starts over the past six years. While Canada has been producing between 210,000 and 270,000 homes annually, the BCH target would mark a near-doubling of that rate—a dramatic increase in national housing output

The strategy includes development on public land, significant investment in prefabricated housing technology, and incentives for affordable housing construction.

Lowering costs for buyers and builders

A centrepiece of the BCH platform is the elimination of the GST on homes under $1 million for first-time buyers. In places like Toronto or Vancouver, this could mean immediate savings of tens of thousands of dollars. Additional measures like reduced development fees and fast-tracked zoning approvals are designed to further lower costs and speed up project delivery.

What it means for the market

First-time buyers stand to benefit most in the near term. Cheaper builds, reduced taxes, and increased supply could open doors that have been closed for a decade.

For real estate investors and developers, the impacts are more complex. A sudden increase in supply could soften price appreciation and lower rental margins. On the flip side, accelerated zoning and federal funding could make new builds more attractive and less risky.

The BCH plan imagines putting the federal government back in the builder’s seat—but whether a future Liberal government could deliver on timelines, cost control, and intergovernmental coordination remains to be seen.

NDP: Empowering buyers and restraining speculation

Mortgage relief for first-time buyers

The New Democratic Party is focusing its housing platform on affordability for everyday Canadians. Their standout policy is a federally backed low-interest fixed mortgage…

Source link

This article was complied by AI and NOT reviewed by human. More information can be found in our Terms and Conditions.