Don’t miss out—join us online for REM’s monthly market breakdown on April 22 at 2 PM Eastern. REM, columnist Daniel Foch will analyze CREA’s latest stats, market slowdowns, and what shifting buyer sentiment means for Realtors ahead of the federal election. It’s free, no strings attached—register here.

If there’s one lesson March 2025 teaches us about the Greater Toronto Area real estate market, it’s this: gravity isn’t always a bad thing. After years of frenzied growth, soaring prices, and buyer competition that defied fundamentals, the market has begun a pretty serious descent in response to two key uncertainties in Canada’s market:

- Donald Trump’s tariffs; and

- The Canadian election taking place on April 28th.

But here’s the thing; a little bit of “pause and reflect” might be exactly what the market needs. February hinted at the shift, with declining sales, easing prices, and growing hesitation among buyers. March has only made that reality more pronounced. This is, in fact, the slowest spring market we’ve seen since the 1990s.

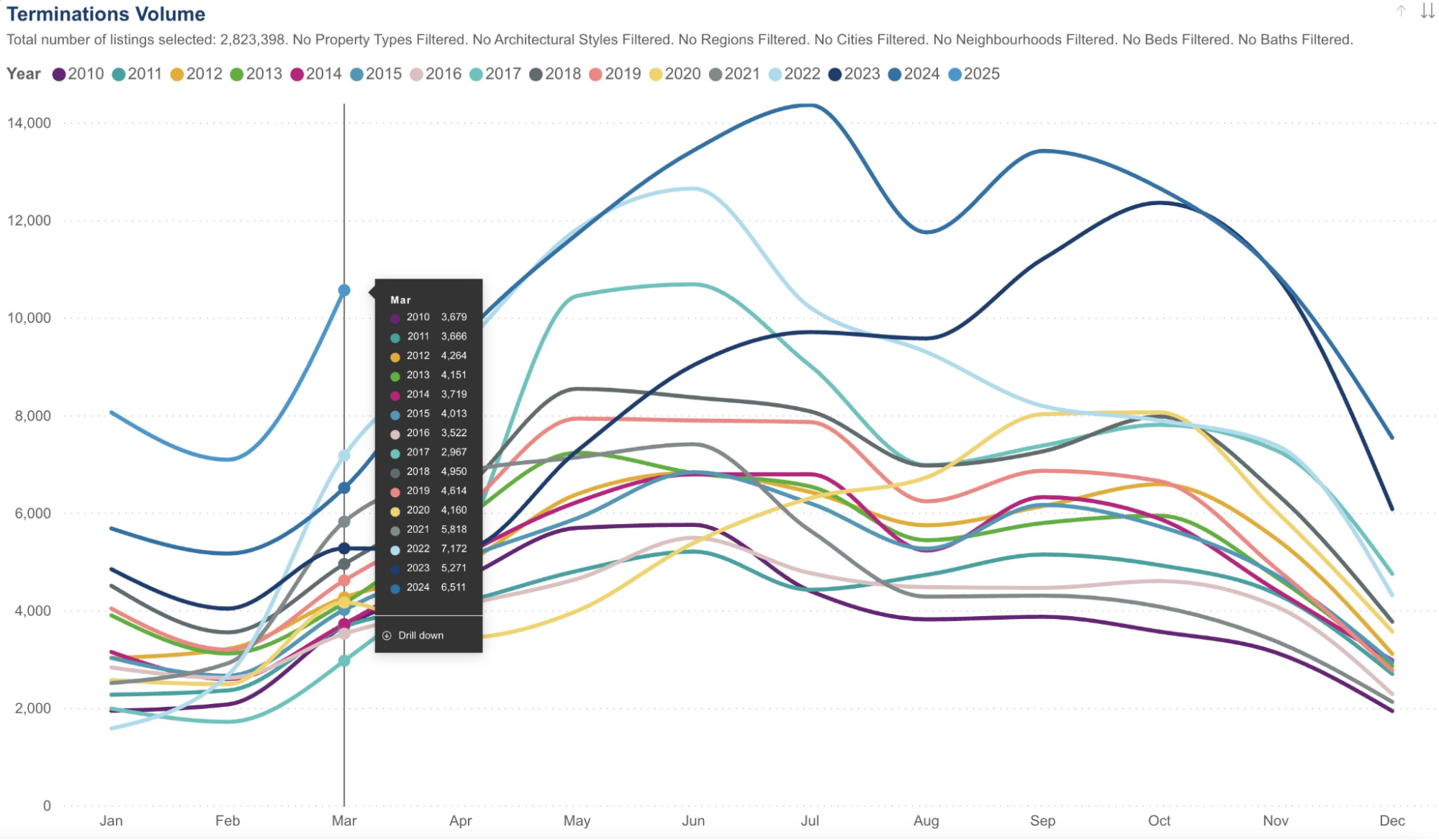

Source: TRREB, The Habistat

This isn’t a collapse, but a necessary recalibration—a sentimental pause that reflects caution, but not yet crisis.

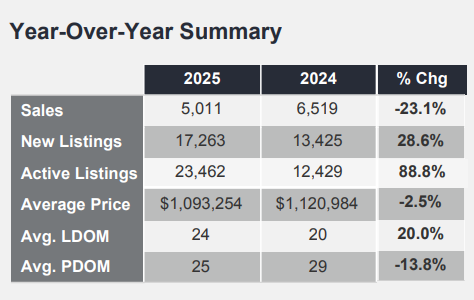

According to the latest figures from the Toronto Regional Real Estate Board (TRREB), sales were down significantly year-over-year, falling by 23.1 per cent. That may sound ominous, but the deeper story is far less dramatic.

In fact, it’s rooted in something remarkably rational: buyers are pausing, not disappearing. And they’re doing so in response to the two aforementioned forces that define our current economic landscape. Just as we saw the market hit “pause” in November during the US election, buyers are patiently waiting to see what type of economy they’ll own property in. Sellers are equally confused, terminating listings at the highest rate we’ve ever seen.

Source: TRREB, The Habistat

Affordability is making a modest comeback

For the first time in several years, affordability is not only improving—it’s becoming a theme. The average sale price across the GTA clocked in at $1,093,254 in March, down 2.5 per cent from the same period last year. The MLS Home Price Index Composite benchmark fell 3.8 per cent year-over-year, a signal that price softening is no longer confined to specific neighbourhoods or housing types—it’s systemic.

TRREB President Elechia Barry-Sproule captured the mood succinctly in TRREB’s monthly market report: homeownership is gradually becoming more attainable. With more inventory on the market, less upward price pressure and expectations of interest rate relief in the months ahead, buyers are regaining something they haven’t had in years—negotiating power. And that shift, while subtle, could have profound consequences for how this market behaves going forward.

The psychological stalemate

If March feels muted, it’s because the market is holding its breath. Policy ambiguity—whether around tariffs, employment or housing—is giving households pause. When consumer confidence falters, so does the willingness to commit to long-term debt.

But this psychological limbo isn’t permanent. The fundamentals—population growth, immigration and housing demand—haven’t changed. What has changed is the emotional tenor of the market. Gone is the “fear of missing out” that defined the pandemic-era run-up. In its place is a kind of measured hesitancy. Buyers want to see where interest rates land, how the federal platforms shake out and whether job security can be taken for granted again. Until then, many are content to wait.

Supply is rising, and that’s a good thing

While buyer activity has cooled, supply is gaining ground. New listings surged 28.6 per cent year-over-year to 17,263, and active listings rose to 23,462—a whopping 88.8 per cent increase in supply compared to last year. This shift is a healthy development in a market that could be creating a pent-up demand scenario while buyers wait on the sidelines. Should buyers decide to return to the market after the election, they’ll have a lot of options to choose from.

A functioning market isn’t one where homes vanish in two days with twenty bids—it’s one where buyers have choices, sellers must justify their pricing, and balance begins to return. In fact, March’s sales-to-new listings ratio landed at just 36.6 per cent—firmly in buyer’s market territory—highlighting how today’s conditions are giving buyers more room to move, even if many are choosing to wait.

With this added inventory has come a natural rebalancing. Homes are taking longer to sell—the average days on market (LDOM) rose from 20 to 24—and pricing is far more elastic. Sellers who cling to 2021 pricing expectations are being met with silence. Those who understand the moment and list accordingly are still moving product. In this new landscape, presentation, precision, and patience matter.

How…

Source link

This article was complied by AI and NOT reviewed by human. More information can be found in our Terms and Conditions.