Looking back at the market in 2024, it reminds me of a significant moment in Toronto’s real estate history: the drastic correction of the early 1990s. During that time, Toronto went through a six-year decline where average home prices dropped by 28% from their peak in 1989. This decline was triggered by a combination of rising interest rates, recession, and overbuilding, leading to the bursting of Toronto’s first major housing bubble.

This correction had a lasting impact on the market. Properties that were once sold for $500,000 in 1989 were now going for $350,000 by 1996. Many developers went bankrupt, leaving unfinished condominiums across the skyline. The term “negative equity” became common among Toronto homeowners as many found themselves owing more on their mortgages than their homes were worth.

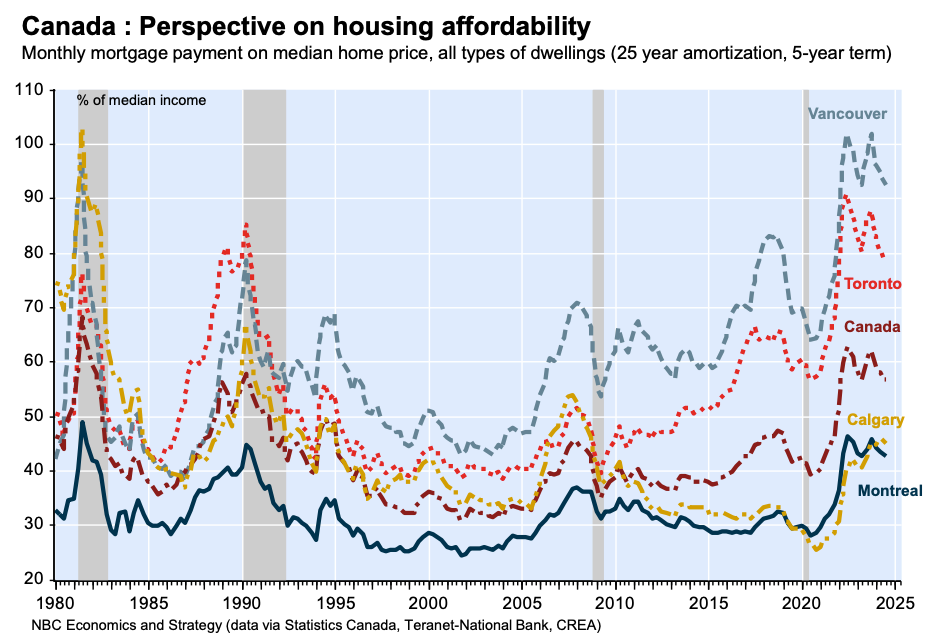

Despite the steep drop, the market seemed relatively “flat” from 1991 to 1996 after the correction. A similar trend can be seen in the chart above, illustrating house prices since the rise in interest rates in 2022.

Current Market Situation

The current market situation shares some similarities with that turbulent period, with falling prices due to rising interest rates, ongoing affordability concerns, an election, changes in capital gains, and economic uncertainty, particularly related to unemployment.

Despite these challenges, it’s interesting to note that the market showed signs of improvement in November, with increased sales but not higher prices. The increased interest in buying homes in the Greater Toronto Area (GTA) is primarily driven by improved affordability.

Housing affordability has improved in the Canadian real estate market, especially in the GTA. Toronto’s housing affordability has seen more correction than any other major city in Canada, as per the National Bank’s Q3 Housing Affordability Monitor.

A correction indicates that mortgage payment costs are decreasing relative to household income, making it more affordable for people to buy homes. This improvement in affordability contributed to a relatively strong market in October and November of 2024, but the momentum slowed down in December.

The main factor driving the improvement in affordability could also pose a risk. RBC noted that the growth in household income significantly contributed to the affordability improvement in the third quarter of 2024. However, certain trends in 2025, such as rising unemployment rates and potential job cuts, could slow down wage growth.

- Rising unemployment rates

- Majority of job growth coming from government hiring

- Expected reduction in government employees by the election winner

Therefore, future improvements in housing affordability may require a reduction in interest rates or house prices. In a healthy market, housing costs in Toronto should ideally be around 40-50% of the median household income, and it is anticipated to reach that point over time.

GTA 2024: Buyer’s Market with Considerations

For years, the GTA housing market was known for its competitive bidding environment, with rising prices and limited supply creating a sense of urgency. However, in 2024, home sales reached 67,610—up 2.6% from 65,877 in 2023—while new listings increased by 16.4% to 166,121. On the surface, this gave buyers an advantage and more options, hinting at a potential market correction.

Despite the increase in listings, the average selling price only slightly decreased by less than 1.0% year-over-year, settling at $1,117,600 compared to $1,126,263 in 2023. Detached homes remained expensive, and condominiums, although experiencing price declines, struggled to attract budget-conscious first-time buyers who hoped for lower interest rates in the future.

Monthly data showed a 1.8% decrease in sales, with notable increases of 20.2% in new listings and 48.5% in active listings. The average price saw a slight decline of 1.6% compared to December 2023, and days on the market increased by 12-15%.

The significant jump in new listings may indicate a relaxation of supply constraints, but many sellers were hesitant to reduce their asking prices. Despite the theoretically balanced supply-demand ratio favoring buyers, the minimal price drop reflects sellers’ reluctance to adjust their expectations, highlighting the continued gap between buyer desires and market realities.

Condominiums: Sector to Watch in 2025

Among all sectors in the GTA real estate market, the condominium sector stands out as a key area of focus. With a record number of new condominium listings and increased supply in 2024, this sector shows no signs of slowing down.

Several factors contribute to this trend. Firstly, the Bank of Canada’s interest rate hikes have made it more challenging for people to buy homes, particularly affecting first-time…

Source link

This article was complied by AI and NOT reviewed by human. More information can be found in our Terms and Conditions.