Don’t miss out—join us online for REM’s monthly market breakdown on April 22 at 2 PM Eastern. REM, columnist Daniel Foch will analyze CREA’s latest stats, market slowdowns, and what shifting buyer sentiment means for Realtors ahead of the federal election. It’s free, no strings attached—register here.

There’s something truly sobering about the March 2025 CREA statistics. The industry has tried to sustain its hallmark optimism against a barrage of negativity in the economy.

For months now, we’ve been whispering about uncertainty—about tariffs, interest rate indecision, macroeconomic jitters. But March 2025 didn’t whisper. It shouted, and what it revealed wasn’t just a housing market on pause, but one beginning to crack under the weight of something deeper: eroding buyer confidence.

Let’s talk facts first. Canadian home sales dropped 4.8 per cent in March compared to February. That’s the fourth month in a row. This is especially concerning when you realize that home sales typically rise through the spring market. Since the high point last November, we’re now down 20 per cent—not exactly the trajectory of a “rebound year,” as some hoped. In fact, these figures mark the weakest March since 2009—and let’s not forget what that year represented for the global economy.

Shaun Cathcart at CREA puts it bluntly, “We’ve gone from a slam dunk rebound year to treading water at best.” I’d go a step further. We’re not treading water. We’re navigating an undertow—quiet but persistent forces pulling at the market’s foundations.

So what’s really going on?

At the surface level, it’s easy to blame tariffs. The cross-border tension has injected volatility into sectors already walking a tightrope. But the slowdown is more than policy friction. It’s emotional. It’s psychological. When buyers are scared—not just of interest rates or job security, but of an unstable global order—they don’t transact. They wait. They sit. They second-guess.

That fear is now measurable. Year-over-year, March sales were down 9.3 per cent. Prices fell too, with the national average dropping 3.7 per cent to $678,331. That number may still feel lofty in most markets, but context is king: this is the sharpest year-over-year price dip we’ve seen in some time and the largest month-over-month index drop since late 2023.

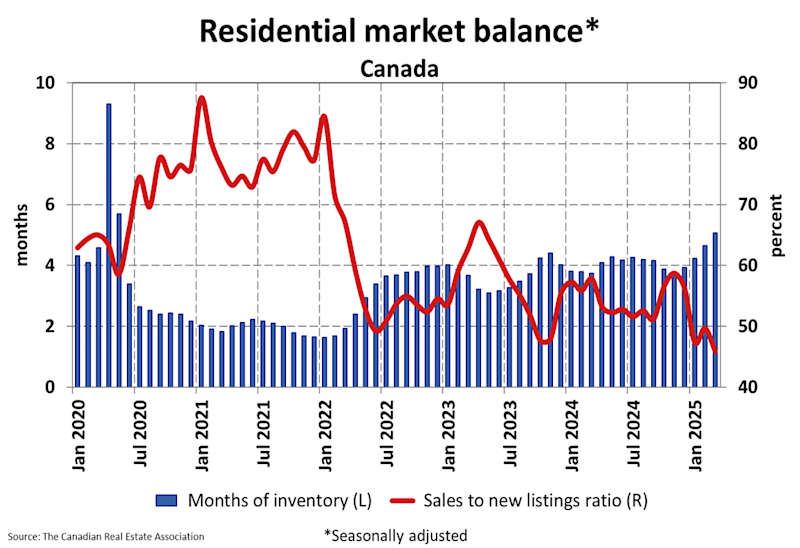

Inventory is climbing—up 18.3 per cent from a year ago. And the sales-to-new listings ratio? Now sitting at 45.9 per cent, it hasn’t been this low since February 2009. It tells us something crucial: sellers are arriving, but the buyers? Not so much.

Canada is not a monolith—and the divide is widening

This is not a uniform market; Ontario and British Columbia are dragging national stats down with steep declines in activity and price. But in the Prairies, Quebec, and parts of Atlantic Canada, prices are still rising.

Translation? We’re seeing the emergence of two Canadas in housing. One, is cautious and cooling (urban, high-priced, economically exposed), while the other is stable or climbing (affordable, less volatile, often overlooked).

This divergence is more than a quirk—it’s a structural shift. We’re moving from a “rising tide lifts all boats” market to one where local resilience matters more than national trends. And that means buyers and sellers need to stop obsessing over headlines and start zooming in on hyperlocal realities.

Where does this leave us?

We’re navigating a market driven less by fundamentals and more by feelings—right now, those feelings are fragile. Buyers are hesitant. Sellers are listing—but they’re second-guessing every step, unsure whether to hold or drop prices. And with Canada officially in election mode, the federal government has slipped into a caretaker posture, sidelining any major housing decisions until a new mandate is in place.

Meanwhile, escalating trade tensions and a fresh volley of tit-for-tat tariffs are tightening the screws on an already fragile economic outlook. Business confidence is showing signs of strain, particularly in trade-sensitive sectors. Consumer sentiment is similarly under pressure, with many Canadians pulling back on major purchases and bracing for more economic uncertainty.

And yet, even in this climate of hesitation, pockets of opportunity persist.

In markets where demand remains tight and inventory is still playing catch-up, we’re seeing price resilience—if not outright growth. For investors and upsizers, today’s softer pricing and reduced competition may offer a window of opportunity not seen in months. First-time buyers, however, are more likely to wait on the sidelines—hoping the next federal government delivers meaningful support before stepping into the market.

My take

This CREA report isn’t just another market update—it’s a mirror. And in it, we see a nation grappling with what it means to return to balance after years of policy…

Source link

This article was complied by AI and NOT reviewed by human. More information can be found in our Terms and Conditions.