Last week, I made new investments in stocks despite potential criticism from skeptics who may consider me naive for doing so during uncertain times. However, I do not see myself as naive. In fact, I am genuinely concerned about the state of the U.S. economy.

One major cause for concern is the U.S. national debt, which recently exceeded $35 trillion. The continuous rise of the national debt at an unsustainable rate is alarming, as it brings us closer to an unknown breaking point.

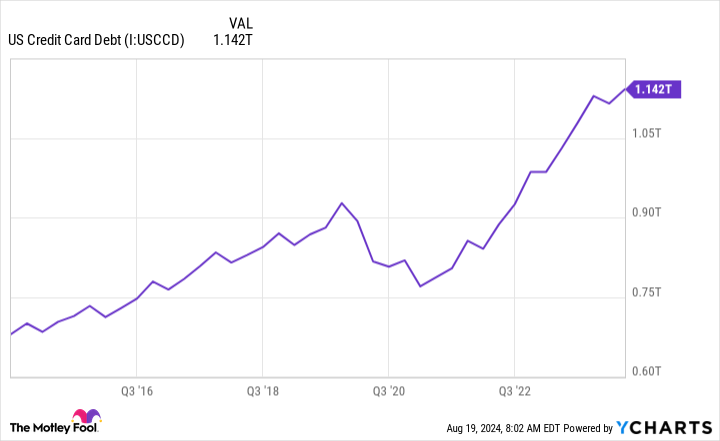

While politicians are often blamed for creating this issue by failing to balance the budget, the average U.S. household is not faring much better. Household debt has reached a record high of $17.8 trillion, including an alarming $1.1 trillion in credit card debt.

While some argue that consumer spending remains “resilient,” the alarming increase in debt questions the sustainability of this resilience. It is evident that a point may soon be reached where credit runs out, leaving consumers with minimal liquidity due to depleted cash reserves.

In summary, the escalating government spending could lead to challenging decisions that may negatively impact the economy. Similarly, uncontrolled household spending might trigger a crash in discretionary spending. These are some of the concerning factors regarding the economy.

Why I Continue to Invest

Despite my concerns about the economy, I maintain my investments for several reasons. Over the years, I have witnessed the economy adapt in unexpected ways, which has resulted in consistent growth and stock market highs.

Additionally, historical data shows that the stock market generally trends upwards, making early investments a lucrative opportunity. Rather than allowing fear to dictate my actions, I address my concerns by strategically selecting undervalued businesses with long-term financial stability.

Two businesses that align with this strategy are beverage company Celsius (NASDAQ: CELH) and discount retailer Five Below (NASDAQ: FIVE).

1. Celsius

As of the second quarter of 2024, Celsius held over $900 million in cash and equivalents with no debt. While a strong balance sheet is not the sole indicator of a good investment, it serves as a valuable asset during economic downturns. This is one of the reasons why I am confident in investing in Celsius stock.

Furthermore, apart from attractive valuations, Celsius demonstrates growth potential and improving margins. The company’s rapid ascent to the third position in the energy drinks market, behind Red Bull and Monster, suggests room for continued growth through international expansion.

Moreover, Celsius has the opportunity to enhance its profit margins by optimizing operations. With net profits increasing by 70% in the first half of 2024 compared to the same period in 2023, Celsius appears to be a promising long-term investment.

2. Five Below

Similar to Celsius, I see potential in Five Below stock for long-term investment. With minimal debt and a strong capital position of over $350 million in cash and short-term investments, Five Below is attractively priced at a historical low P/S ratio of 1.

Despite a significant decline in stock value following an unexpected CEO departure and missed expectations, I believe investors are overreacting. While the company anticipates a decline in same-store sales for 2024, the expectation of a nearly…

Source link

This article was complied by AI and NOT reviewed by human. More information can be found in our Terms and Conditions.